Growing businesses facing finance and accounting (F&A) challenges must decide whether to invest in building their function in-house vs. outsourcing to a third-party.

Building in-house is the traditional method, but outsourcing accounting services has become an increasingly popular alternative. In fact, 4 out of 5 investor-backed CFOs reported working with a finance and accounting partner last year.

As a leader in outsourced financial services, Consero knows when it makes sense to build an in-house team and when outsourcing is the smarter choice. This guide will help you make the best decision based on your needs.

In-House vs. Outsourced Finance & Accounting

Before evaluating the pros and cons of each approach, we’ll cover what building an in-house finance team looks like versus outsourcing finance and accounting functions.

In-House

Businesses hire, train, and manage an internal finance and accounting team, typically consisting of a CFO, Controller, accountants, and support staff.

This team is responsible for handling financial reporting, budgeting, tax compliance, and other finance-related functions within the company.

Companies also purchase an accounting software license in-house, and are responsible for maintaining their systems.

Outsourcing

Companies partner with an external provider that delivers finance and accounting services as needed.

Certain models, such as Finance as a Service (FaaS), deliver an entire accounting function including access to finance professionals, automation tools, cloud-based accounting software, and standardized processes without requiring full-time hires.

Advantages of Building In-House

Building an in-house finance team offers direct control over financial processes, deeper company knowledge, and customized workflows.

Businesses that want constant hands-on financial oversight may benefit from an internal team.

|

Control |

Companies maintain direct oversight of financial processes and decision-making. |

|

Company-Specific Knowledge |

Internal teams develop deep familiarity with the business, industry, and specific financial challenges. |

|

On-premise Accessibility |

On-site teams can provide instant support and collaboration for executives and other departments. |

|

Custom Processes |

Businesses can tailor financial workflows and reporting structures to their unique needs. |

Disadvantages of Building In-House

While an internal finance team offers control and familiarity, it comes with significant costs and scalability challenges. Hiring and maintaining skilled finance professionals can be expensive and time-consuming.

|

High Costs |

Salaries, benefits, office space, software, and training add significant overhead. |

|

Talent Acquisition & Retention |

Recruiting and retaining top finance professionals is difficult and costly. |

|

Scalability Challenges |

Expanding finance functions requires additional hiring and training, slowing growth. |

|

Limited Technology + Automation |

Internal teams may lack the resources to implement advanced financial systems and automation tools. |

Advantages of Outsourcing

Outsourced finance and accounting provides cost-effective, scalable solutions with access to experienced professionals and cutting-edge technology.

Businesses that need rapid implementation and automation can benefit from outsourcing’s advantages.

|

Cost Savings |

Reduces hiring and overhead costs, providing a full finance function at a lower, more predictable cost structure. |

|

Access to Expertise |

Gain immediate access to experienced CFOs, Controllers, and accountants without hiring full-time staff. |

|

Faster Implementation |

Can be deployed in weeks rather than months. |

|

Scalability & Flexibility |

Financial support resources scale up or down based on needs of the business. |

|

Technology + Automation |

Providers use advanced financial software that streamline reporting and compliance. |

Disadvantages of Outsourcing

Despite its benefits, outsourcing finance and accounting may not be suitable for every business.

Companies that require full control over financial operations or have unique, highly customized processes may find outsourcing less adaptable.

|

Less Direct Control |

While outsourcing offers expertise, businesses may feel less hands-on in financial decision-making. |

|

Communication and Coordination |

Companies need to work with providers to integrate with internal teams and align with company goals. |

|

Standardized Processes |

While efficient, outsourced solutions may lack the full customization of an in-house team. |

1. Cost

Cost is a major factor in deciding between in-house and outsourced F&A, where outsourcing offers clear benefits. Hiring a full finance team is expensive, while outsourcing provides a fixed-cost alternative.

In-House

Hiring a CFO ($250K+), Controller ($150K+), Finance Manager ($100K+), and support staff results in significant payroll costs.

Additional expenses include benefits, office space, training, and software.

Outsourcing

FaaS solutions provide a full finance function including people, processes, and systems at a fixed, predictable cost. Outsourcing typically reduces expenses by 30-50% compared to an in-house team.

2. Time to Build

Businesses must consider how quickly they need financial expertise. Building an internal team takes time, while outsourcing is like an “out-of-the-box” finance function.

In-House

Hiring, onboarding, and training an accounting team can take months, delaying operational improvements.

For rapidly growing businesses, implementing an Enterprise Resource Planning (ERP) system in-house typically takes 12-18 months (as well as a third-party to facilitate), as it requires system selection, customization, integration, and training.

Outsourcing

FaaS providers like Consero can deploy a full finance team, complete systems integrations, and establish internal controls and processes within 30-90 days.

Under FaaS, ERP and automation are pre-integrated into a single solution, allowing for immediate scalability without a lengthy implementation period.

3. Technology

Digital transformation plays a crucial role in modern finance and accounting operations. Businesses must determine whether to invest in and maintain their own systems or leverage outsourced solutions that come with built-in automation.

In-House

Companies must purchase, integrate, and manage accounting and financial software, requiring ongoing updates and IT support.

Outsourcing

Providers offer advanced cloud-based financial platforms with automation capabilities, reducing manual processes, improving reporting accuracy, without requiring a substantial investment.

4. Standardized vs. Customized Workflows

Businesses with unique financial reporting needs must decide between standardized processes and fully customized workflows.

In-House

Internal teams can build highly customized financial processes tailored to the company’s specific needs but require ongoing maintenance.

Outsourcing

FaaS solutions are able to operationalize finance functions quickly because they provide pre-built, standardized frameworks that ensure compliance and efficiency.

5. Focus on Core Objectives

SMBs, particularly those that are investor-backed, need to focus on mission critical activities that will drive the business forward. At the same time, the finance function must scale in lockstep with the company’s growth.

In-House

F&A teams are typically small at SMBs, with one or two people collecting and depositing checks, invoicing customers, reconciling the bank account, and also managing and preparing the financial statements.

When operations grow in complexity, the firm’s financial leadership often becomes absorbed in daily transactional work, leaving little time for strategic initiatives.

Outsourcing

By outsourcing transactional accounting tasks and back-office functions to a finance and accounting partner, internal leadership can focus on growth strategies, M&A, and customer acquisition.

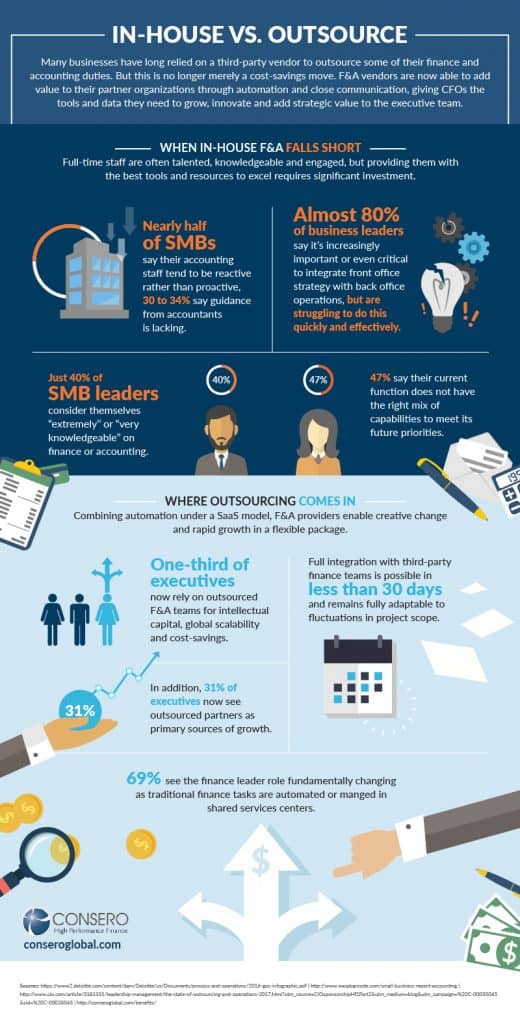

In-house vs. Outsource Infographic

Consero’s visualization breaks down some of the key challenges SMBs face when building in-house, and how outsourcing helps.

Which is Right for Your Business?

Choosing between an in-house finance team and outsourcing depends on your company’s specific needs, priorities, and resources.

Building in-House is best for businesses that:

- Require full control over financial processes.

- Have the budget to hire and retain skilled finance professionals.

- Operations demand highly customized financial workflows.

- Are stable and mature with predictable finance needs.

On the other hand, outsourcing is the better choice for businesses that:

- Need a cost-effective solution without hiring a full in-house team.

- Need on-demand access to experienced finance professionals.

- Are scaling quickly and need a finance function that can grow with it.

- Want access to advanced financial technology and automation tools without heavy investments.

- Have investors require fast, accurate, and GAAP-compliant financial reporting.

How Consero Can Help

For businesses looking to scale quickly, improve financial visibility, and optimize costs, outsourcing finance and accounting with Consero is often the smarter choice, with tailored solutions to meet your needs at every stage of growth.

Our Finance as a Service (FaaS) model delivers the technology, processes, and people you need to establish a world-class finance department quickly.

If you like your existing systems, our Flex Finance service integrates with your current technology stack and manages your back-office finance function.

When you need skilled talent, we can supplement your accounting staff with experienced professionals.

If you’d like to learn more, request a consultation with Consero to find the best solution for your needs.