For PE Sponsors, harnessing benchmarking data around a Finance & Accounting Organization across human capital, processes and systems can be an invaluable tool to drive value creation initiatives and compel change at a portfolio company

Private equity sponsors have a new value creation tool at their disposal: benchmarking the Finance & Accounting (F&A) spend at each portfolio company against peers to bring each in line with best in class industry standards

Many PE sponsors are now employing an army of operating partners to parachute into portfolio companies, drive value creation initiatives, and transform companies. The Finance & Accounting organization, has often been a challenge to assess absent industry benchmarking data as to what a world class F&A org looks like under the pillars of people, processes and systems when optimized for growth.

Consero, a pacesetter in Finance as a Service (FaaS), takes a deep look at F&A for our clients offering troves of benchmarking data to assess where each company stacks up. To date, there was no good way for measuring the spend at companies, holistically across people, processes, and systems despite the fact that many other functional areas have widely published efficiency metrics. Most Private Equity sponsors don’t know the true cost of a portfolio company’s F&A function, leaving it up to the CFO to play judge and jury. And of course, few CFOs will acknowledge that they are not running a tight ship.

Consero created a database comprised of the F&A budgets of over 1,000 current and former clients in middle market PE backed companies in SaaS, technology, and business services. The total F&A cost is calculated by adding the cost of personnel to the cost of technology employed by the F&A org and is then reported as a percentage of the company’s total revenue.

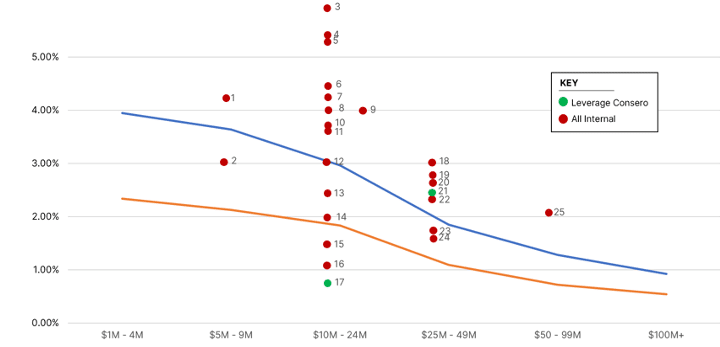

The results for one PE sponsor’s (middle market tech growth firm) are represented in the figure to the right.

The F&A spend for each portfolio company is represented by each red circle arranged as a percentage of revenue, represented on the left side of the chart. The bottom X axis represents the ARR bands highlighting the PE sponsor’s target preference for companies in the $10-20MM ARR range (with several in the $25-50MM ARR range.

Consero found that for our top 50% clients, represented by the orange line, F&A spend is approximately 2% of revenue for a company with $10-24MM in ARR. That spend continues to trend lower as company revenue increases providing material economies of scale and EBITDA improvement. The blue line represents all companies, including those with a large in-house F&R staff which hovers around 3% of revenue.

The green circles represent the two portfolio companies that this PE sponsor engaged Consero to support with our FaaS or Finance as a Service model. Portco #17’s F&A org has been fully optimized by Consero, while Portco # 21 retained a substantial in-house team in addition to Consero’s. As a result, Consero will be assuming more work and reducing staff for the latter to keep driving the F&A cost down.

Across our benchmarking research, Consero regularly finds minimal correlation between F&A cost/spend and quality of the output, i.e. the organizations’ ability to produce quality and timely financials and the exec team and investors ability to trust the data. In this case, Portcos #3, #4 and #5 (those with the highest spend) often produced late and inaccurate financials, and were paying a premium for an org that couldn’t even deliver the basic requirements expected out of an F&A organization. Consero’s FaaS approach wasn’t merely driving down costs, but materially improving the quality of the F&A function and driving material EBITDA improvement.

In the next figure, we see what would happen if Consero were to support the F&A function at 15 of the PE sponsor’s portfolio companies, and through optimization of F&A, and correlated their spend inline with Consero’s top 50% of clients. This case assumed a 15x EBITDA multiple across the portfolio (all software companies)

| Client Name | Annual Revenue | Current F&A % of Revenue | Optimized F&A% of Revenue | Delta | Gained or Lost EBITDA | Potential Valuation Implication (@15X EBITDA) |

|---|---|---|---|---|---|---|

| 1 | $ 15,000,000 | 7.33% | 1.83% | -5.50% | $ (825,500) | $ (12,382,500) |

| 25 | $ 51,000,000 | 2.16% | 0.72% | -1.44% | $ (732,800) | $ (10,992,000) |

| 18 | $ 35,000,000 | 3.10% | 1.09% | -2.01% | $ (703,500) | $ (10,552,500) |

| 19 | $ 40,000,000 | 2.75% | 1.09% | -1.66% | $ (664,000) | $ (9,960,000) |

| 4 | $ 11,000,000 | 5.45% | 3.86% | -1.59% | $ (175,000) | $ (2,625,000) |

| 20 | $ 33,000,000 | 2.64% | 1.09% | -1.55% | $ (510,300) | $ (7,654,500) |

| 8 | $ 22,000,000 | 4.09% | 1.83% | -2.26% | $ (497,400) | $ (7,461,000) |

| 10 | $ 23,000,000 | 3.70% | 1.83% | -1.87% | $ (429,100) | $ (6,436,500) |

| 7 | $ 17,000,000 | 4.29% | 1.83% | -2.46% | $ (417,900) | $ (6,268,500) |

| 5 | $ 11,000,000 | 5.45% | 1.83% | -3.62% | $ (398,700) | $ (5,980,500) |

| 22 | $ 28,000,000 | 2.48% | 1.09% | -1.39% | $ (388,036) | $ (5,820,540) |

| 9 | $ 15,000,000 | 4.04% | 1.83% | -2.21% | $ (332,108) | $ (4,981,619) |

| 24 | $ 42,000,000 | 1.79% | 1.09% | -0.70% | $ (292,200) | $ (4,383,000) |

| 6 | $ 10,000,000 | 4.50% | 1.83% | -2.67% | $ (267,000) | $ (4,005,000) |

| 11 | $ 13,000,000 | 3.65% | 1.83% | -1.82% | $ (237,100) | $ (3,556,500) |

This begs the question as to how PE sponsors might apply this data across an existing portfolio. Without data to support change and optimization, investors and operating partners are hamstrung to push for improvement. Consero’s PE sponsor clients regularly commission Consero to conduct a similar gratis assessment across a full portfolio or select number of portcos to provide the empirical data and equip investors and operating partners to drive optimization, EBITDA and margin improvements within F&A. With the right dose of data and diplomacy, cutting F&A spend can leave a company stronger than before, and help contribute to value creation and execution of the original investment thesis.

Please reach out if you would like a more in depth presentation on our benchmarking data and methodology and if you would like Consero to run a gratis benchmarking analysis across your portfolio or a subset of your portfolio.

Build it Yourself Solution

Consero FaaS Solution

Build it Yourself Solution

Consero FaaS Solution